does tennessee have inheritance tax

They may need to sell off some assets to have enough cash to pay the outstanding debts including medical bills and credit card bills. Intuit will assign you a tax expert based on availability.

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification.

. How to Read a Will. If an estate does have to go through probate though filing the will is the first step in getting that process started. Then multiply the product by the tax rate.

For more information contact your local assessor of property or visit the Tennessee Comptroller of the Treasurys Division of Property Assessments. Does Your State Collect an Inheritance Tax. Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed.

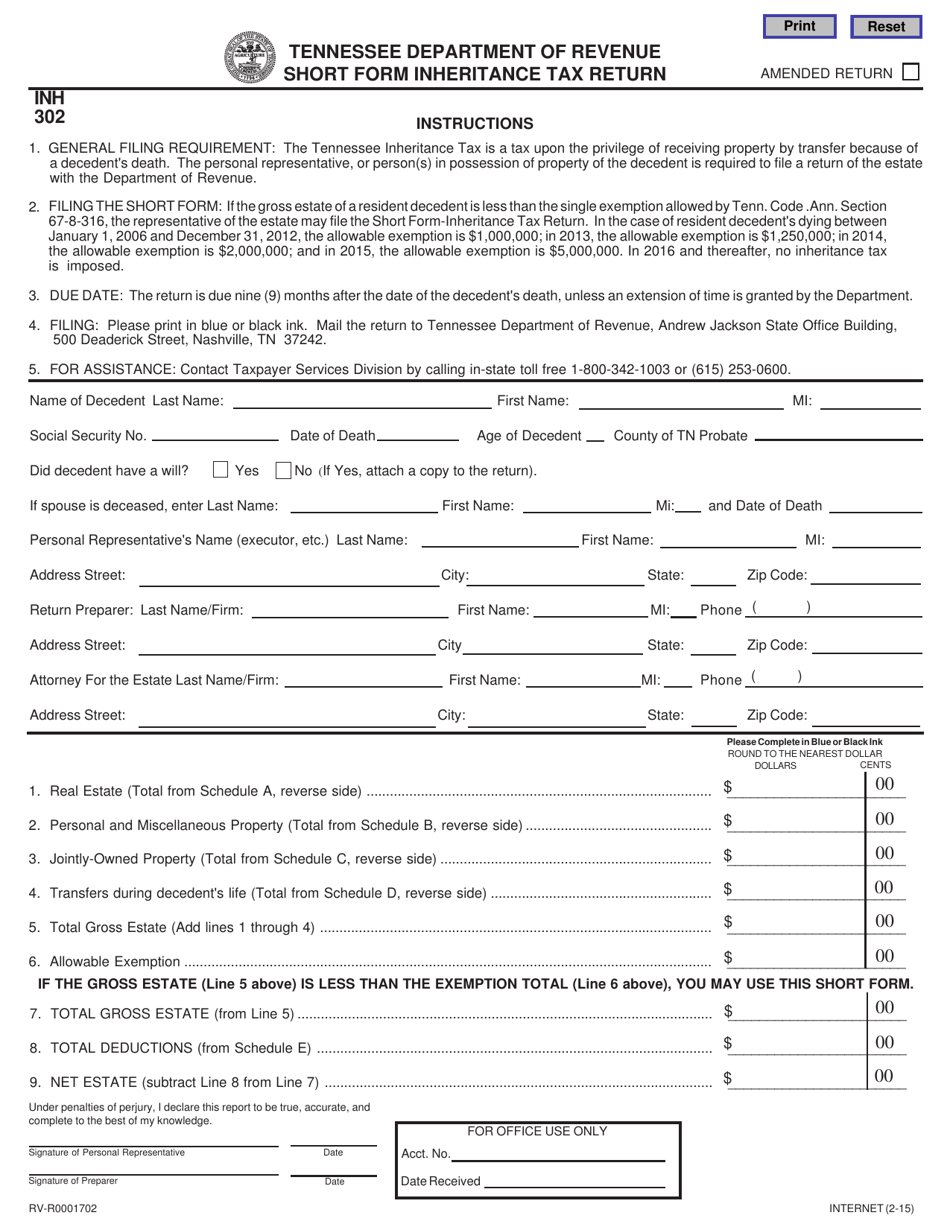

Tennessees inheritance tax is calculated more like an estate tax ie the tax does not vary based on the beneficiary. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022. People you give gifts to might have to pay Inheritance Tax but only if you give away more than 325000 and die within 7 years.

Tax Advice Expert Review and TurboTax Live. One state Maryland imposes both types of taxes but the estate tax paid is a credit against the inheritance tax so the total tax liability is not the sum of the two but the greater of the two taxes. States that dont have an income tax gained a net inflow of 285000 new residents leaving from the 41 states that did charge an income.

The executor will also pay the creditors as their claims are received. All states that collect an estate tax offer exemptions and the value of these exemptions can vary. Only the net value of an estate that exceeds the exemption amount is taxed and the.

Passing on a home. Oklahoma and Kansas have also repealed their estate taxes. Tennessee followed suit in 2016 and New Jersey and Delaware eliminated their estate taxes as of 2018.

Tennessee Inheritance Laws What You Should Know Smartasset

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Inheritance Laws What You Should Know Smartasset

Tennessee Health Legal And End Of Life Resources Everplans

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

Kentucky Or Tennessee To Retire Kentucky Tennessee Retirement

Probate Fees In Tennessee Updated 2021 Trust Will

The Surviving Spouse Estate Tax Trap When Someone Dies Estate Tax Inheritance Tax